calculator

Net Operating Income (NOI) Calculator

Our NOI Calculator simplifies the process for property owners.

Just input your monthly rent, and the calculator takes care of the rest.

Project your NOI over three years and discover how Profit Protect shields you from inevitable vacancies and big repairs.

(Numbers reflect a 3-year period.)

Home365 Profit Protect

Home365 Profit Protect

Our competitions

Our competitions

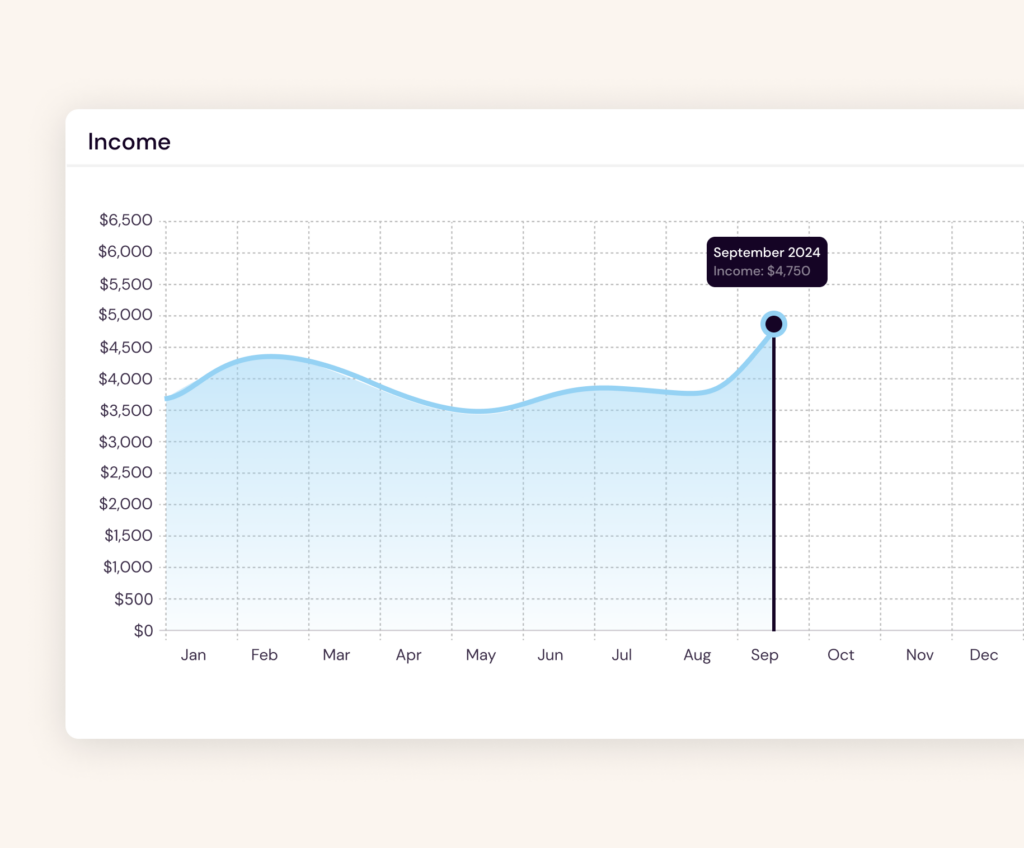

Monthly rent you expect to earn from your property

Actual management fee varies depending on your property’s unique attributes

Various wear and tear issues, such as a broken A/C or leaky faucet, and turnover costs

Costs for advertising vacancies, tenant screenings, lease renewals, evictions, and legal processing

Periods when a property is unoccupied, leading to lost rental income and turnover costs

Missed or late rent payments from tenants, leading to lost income and potential legal costs

Your rental income minus operating expenses and vacancies

Why is Net Operating Income important?

Which Property Should You Buy?

Net Operating Income (NOI) is a vital metric for property owners and investors alike, offering valuable insight into a property’s profitability. By calculating NOI, you can quickly assess whether your rental income outweighs your operating expenses, making it easier to determine if owning and maintaining a property is financially worthwhile.

How Can You Protect Your Net Operating Income?

For investors, understanding NOI allows for smarter comparisons across multiple properties, as it standardizes profitability metrics. With our Profit Protect Plan, your NOI becomes both higher and more predictable. By covering vacancy, delinquency, and other common expenses, we help ensure your property consistently generates strong returns. This stability in income allows you to make informed decisions with confidence, knowing that your NOI is optimized and reliable, aligning seamlessly with your financial goals and investment strategy.

NOI and Cap Rate

Cap Rate is a crucial metric for real estate investors, showing the potential return by comparing a property’s NOI to its market value or purchase price. The formula is simple:

Cap Rate (%) =

Net Operating Income (NOI)÷Property Value

For example, if a property has an NOI of $40,000 and a value of $500,000, the Cap Rate is 8%.

A higher Cap Rate typically suggests a higher return on investment, though it may also come with increased risk. For investors with a more conservative approach, a stable, lower Cap Rate might be preferable, while those seeking higher returns might pursue properties with a higher Cap Rate.

Conclusion

When assessing a property’s potential, NOI is a crucial indicator of how well its income measures up against its operating costs. With our Profit Protect Plan, we go beyond simply reducing expenses—we cover your losses from vacancy, delinquency, and more, ensuring a higher, more stable NOI.

Ready to protect your profits?