Homeownership inevitably comes with the need for repairs and maintenance. From appliance breakdowns to plumbing issues, costs can add up quickly. One way homeowners and landlords attempt to mitigate these expenses is through home warranties. But how do these warranties work, and are they really worth the investment? Let’s explore the ins and outs of home warranties, when they’re most effective, and some alternatives that may offer more comprehensive protection for rental property owners.

What Is a Home Warranty?

A home warranty is a service contract that covers the repair or replacement of major home systems and appliances due to normal wear and tear. Unlike homeowner’s insurance, which covers damage from events like fires or natural disasters, a home warranty specifically targets systems and appliances that might break down over time. These warranties typically include items like HVAC systems, plumbing, electrical systems, and essential appliances such as refrigerators and ovens.

Home warranties are renewable annually, and coverage can vary widely depending on the provider and plan. They usually involve a set fee for each service call, which the homeowner pays when requesting a repair.

When Is a Home Warranty Worth It?

A home warranty might be worth considering if:

- You Own Older Appliances and Systems: If your home’s appliances and systems are aging, a home warranty can be a cost-effective way to cover repairs or replacements as they wear out.

- You Prefer Convenience: For those who would rather not spend time finding repair technicians and comparing quotes, a home warranty offers a single point of contact for all covered repairs.

- You Don’t Have Significant Savings for Emergency Repairs: If an unexpected repair could strain your finances, a home warranty can provide peace of mind by helping to cover these unforeseen expenses.

In these cases, a home warranty can help smooth out costs over time, providing a buffer against financial surprises.

Read more: Rental Property Insurance Tips That Prevent Pain and Save Money

When Is a Home Warranty Not Worth It?

While home warranties can be helpful, they’re not always the best option for every homeowner. Consider skipping a home warranty if:

- You Have New Appliances and Systems: Many new items are already covered by manufacturer warranties, which typically last one to three years. Adding a home warranty might not provide much additional benefit in these cases.

- You Regularly Maintain Your Home Systems: Regular maintenance can extend the lifespan of home systems and appliances, potentially reducing the need for costly repairs. If your appliances are well-maintained, a home warranty might not offer significant value.

- You’re Comfortable With DIY Repairs: If you have the skills to handle basic repairs, you may not need a home warranty. While some issues require professional attention, many common problems can be tackled by a handy homeowner with the right tools.

You Have an Emergency Fund: If you’ve set aside funds for potential repairs, you might prefer to handle these costs out of pocket, avoiding service fees and coverage limitations associated with home warranties.

What Is Covered in a Home Warranty Policy?

Home warranties generally cover a range of home systems and appliances. Coverage can include:

- Major Systems: HVAC, plumbing, electrical, and sometimes septic systems.

- Appliances: Kitchen appliances like refrigerators, ovens, dishwashers, and laundry machines.

- Optional Add-Ons: Some providers offer additional coverage for pools, spas, second refrigerators, and other specific items.

The exact coverage depends on the policy and provider, so it’s essential to review your contract to understand what is and isn’t included.

How Do Home Warranties Work?

When an appliance or system breaks down, the homeowner contacts their warranty provider, who then arranges for an approved technician to assess the issue. Here’s a step-by-step look at the process:

- Request Service: You file a claim online or over the phone with your warranty provider.

- Pay Service Fee: A set service fee is charged for each repair visit, which typically ranges from $50 to $125.

- Repair Assessment: The technician assesses the issue and, if covered, performs the repair or orders replacement parts.

- Coverage Limits Apply: Most policies have limits on the amount they’ll pay for specific repairs or replacements. If the cost exceeds the coverage limit, you may be responsible for the difference.

It’s worth noting that some repairs might take time due to parts availability or the technician’s schedule. Additionally, not all providers allow you to choose your own repair company, which can affect repair quality and timing.

Read more: Why a Rental Property Management Company Should Require Renter’s Insurance

What Don’t Home Warranties Cover?

While home warranties can provide broad coverage, there are common exclusions to be aware of:

- Pre-existing Conditions: Issues that existed before the warranty coverage began are typically not covered.

- Improper Maintenance: If a breakdown results from inadequate maintenance or installation, the warranty may not cover it.

- Certain Structural Elements: Items like windows, walls, flooring, and the home’s foundation are generally excluded from coverage.

- Damage Due to Natural Disasters: These are usually covered under homeowner’s insurance rather than a home warranty.

- Wear and Tear Beyond Normal Use: Excessive wear or misuse can lead to claim denials.

It’s crucial to read the fine print of your warranty contract to understand what is and isn’t included. Exclusions vary by provider, and it’s wise to confirm that the policy aligns with your specific needs.

Is a Home Warranty the Same as Home Insurance?

No, home warranties and home insurance serve different purposes. Home insurance covers damage to your home and personal property from incidents like fires, storms, and theft. It also includes liability protection if someone is injured on your property. On the other hand, a home warranty is designed to cover the repair or replacement of systems and appliances due to normal wear and tear.

While home insurance is typically mandatory for homeowners with a mortgage, home warranties are entirely optional. Homeowners might find value in having both, as they provide complementary types of coverage. However, a home warranty is not a replacement for home insurance.

Do I Need a Home Warranty?

Deciding whether to invest in a home warranty depends on your situation. If you’re buying an older home or one with outdated systems, a warranty could provide reassurance against unexpected repairs. However, if you’re purchasing a new home or one with recently updated appliances, you may not need the additional coverage.

Consider the following questions to help make your decision:

- Are your appliances and systems relatively new and still under manufacturer warranties?

- Do you have a financial cushion for emergency repairs?

- How comfortable are you with handling minor repairs or finding contractors?

If you’re unsure, it might make sense to get a home warranty for the first year after buying a home, especially if the property has older systems. This allows you time to evaluate the condition of the home while having some protection against major repair costs.

How to Choose a Home Warranty

If you decide a home warranty is right for you, it’s essential to choose the right provider. Here are some tips to guide your selection:

- Compare Providers: Research reputable companies, read customer reviews, and compare plan options.

- Review Coverage Options: Make sure the policy covers the systems and appliances you’re most concerned about.

- Understand Exclusions and Limits: Carefully read the service contract to understand any exclusions and coverage limits.

- Consider Service Fees: Different providers charge different fees for each service call. Factor this into your budget.

- Check for Flexibility: Some providers allow you to select your own repair technician, while others assign one for you. If you have a preferred contractor, confirm whether they can be used under your warranty.

Home Warranty Alternatives

While home warranties can be beneficial, they’re not the only way to protect your home’s systems and appliances. Here are some alternative approaches:

- Emergency Savings Fund: Setting aside money specifically for home repairs can give you financial flexibility without the constraints of a home warranty contract.

- Manufacturer Warranties: Many appliances and systems come with manufacturer warranties. Review these before purchasing a home warranty to avoid redundant coverage.

- Home Insurance Endorsements: Some insurance providers offer endorsements that cover electrical or mechanical breakdowns for an additional fee.

- Regular Maintenance: Routine maintenance can help extend the life of your home’s systems, reducing the need for repairs. This might make a home warranty unnecessary, particularly if your systems are well cared for.

Each of these alternatives has its pros and cons. For some, the predictability of a home warranty might outweigh the flexibility of managing an emergency fund. For others, a mix of savings and manufacturer warranties might be more appealing.

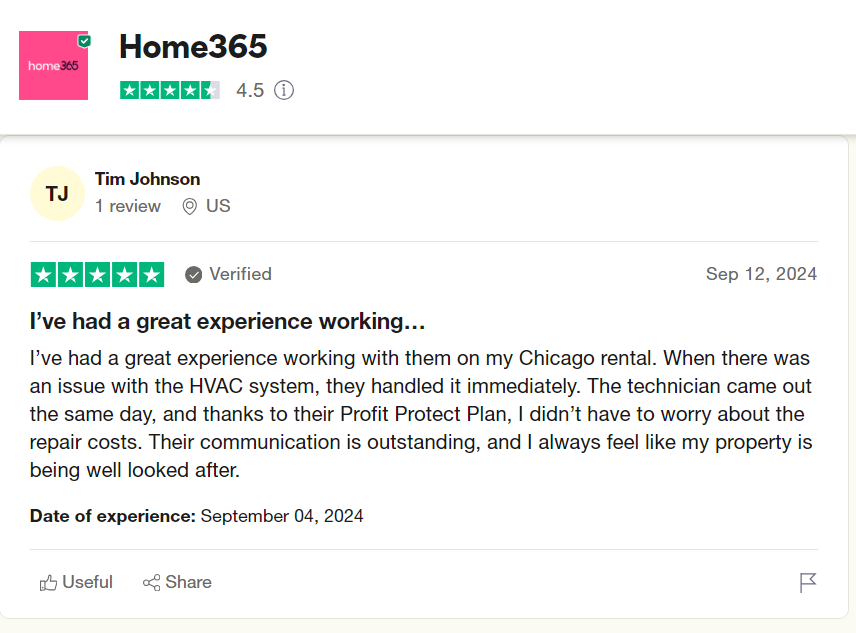

Introducing Profit Protect: More Than a Home Warranty

While home warranties offer useful coverage, they don’t address some of the key concerns faced by rental property owners. Specifically, they don’t protect against lost rental income or tenant-related challenges. That’s where Profit Protect comes in.

Profit Protect is not a home warranty or an insurance policy. Instead, it’s a comprehensive property management plan that combines maintenance coverage with income protection. Profit Protect offers:

- Rent Protection: We cover lost rent if your tenant defaults, ensuring your income remains steady.

- Vacancy Protection: If your property becomes vacant, we cover your rental income until a new tenant is secured.

- Repairs and Turnover Protection: Profit Protect covers repair costs for normal wear and tear, as well as turnover costs to make the property ready for new tenants.

- No Hidden Fees: From leasing costs to evictions, Profit Protect covers all aspects of property management, with no surprise fees.

Final Thoughts: Weighing Your Options

When it comes to protecting your home or rental property, there’s no one-size-fits-all solution. Home warranties can offer peace of mind for certain repairs and maintenance, but they also come with limitations that may not address every need, particularly for landlords managing rental income and tenant turnover.

It’s important to carefully consider your options and what’s most important for your situation—whether it’s having a warranty to cover appliance breakdowns or seeking a more comprehensive approach to protect your property and rental income.

For those looking for a broader solution that includes both maintenance and income protection, exploring alternatives like Profit Protect can be worth considering. To learn more about how these types of plans work and whether they align with your needs, feel free to visit our website for further details.