Real estate investors have long considered Atlanta a top destination for building wealth, and it’s easy to see why. With a robust economy, rising population, and infrastructure development driving up property values, Atlanta presents significant opportunities for savvy investors.

Whether you’re looking for steady rental income, long-term property appreciation, or tax advantages, Atlanta offers something for everyone. But like any market, there are considerations to weigh before diving in. This guide breaks down the essential factors to help you make an informed decision.

Why Atlanta is an Ideal Market for Real Estate Investment

1. Strong Rental Demand

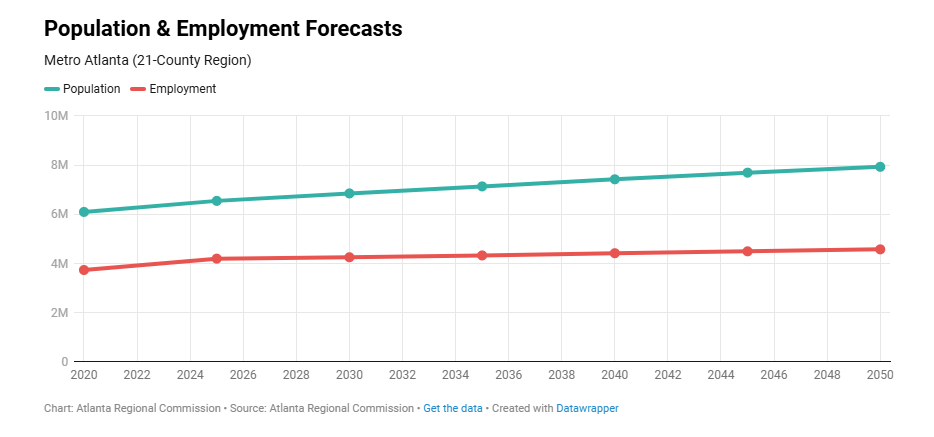

Atlanta’s growing population creates a constant demand for rental housing. As of 2023, the metro area’s population had reached over 6 million and is projected to grow to 7.9 million by 2050, adding approximately 1.8 million new residents.

This influx is driven by Atlanta’s strong job market and diverse industries, attracting professionals, students, and families. For investors, this means lower vacancy rates and a consistent stream of rental income. Properties near employment hubs like Midtown or universities like Georgia Tech and Emory University experience particularly high demand.

Read more: How Much Should I Rent My Atlanta Property For in 2025?

2. Rising Property Values

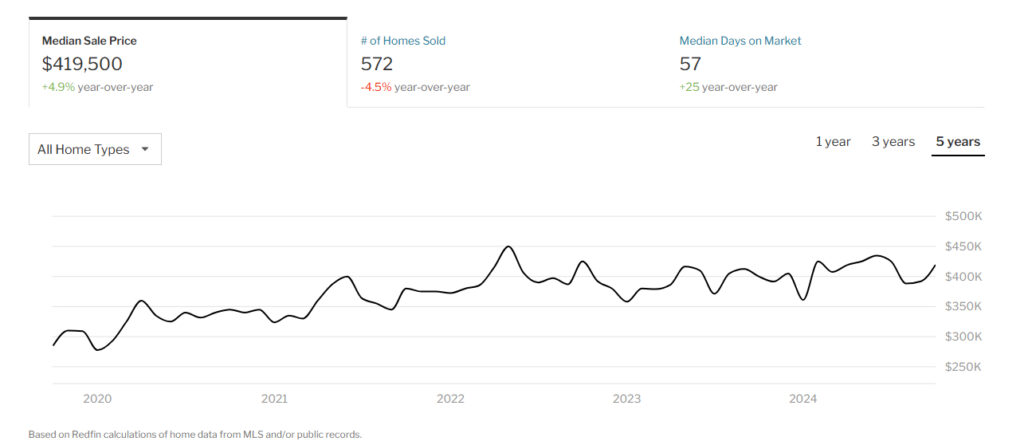

Over the past decade, home prices in Atlanta have risen by an impressive 124%, with a median sale price of $420,000 as of October 2024.

This steady appreciation makes Atlanta a great option for investors seeking long-term equity growth. Urban redevelopment projects like the Atlanta BeltLine have accelerated property value increases in neighborhoods close to new parks, trails, and amenities.

3. A Thriving Economy

Atlanta’s economy is diverse and resilient, with strong contributions from sectors like technology, film production, logistics, and healthcare. The metro area added over 856,000 jobs between 2020 and 2023 and ranks as one of the top cities for job creation.

With major corporations like Coca-Cola, Delta Air Lines, and UPS headquartered in Atlanta, the city continues to attract a steady influx of professionals. This economic stability translates into consistent housing demand, both for homebuyers and renters.

Affordable Entry Points and Supply Considerations

Despite rising prices, Atlanta remains more affordable than other large U.S. cities. Compared to markets like Los Angeles or New York, the cost of entry for Atlanta properties is lower, with opportunities in suburban areas like Roswell and Decatur offering attractive returns.

However, supply is tightening, with 569 homes sold in October 2024, down slightly from 596 the previous year. Investors looking to capitalize on Atlanta’s growth should act soon to secure properties while affordability remains favorable.

Infrastructure Development as a Growth Driver

Atlanta’s infrastructure investments are a key reason for its real estate success. The Atlanta BeltLine, a 22-mile loop of multi-use trails and parks, has transformed neighborhoods and significantly boosted property values. Properties near the BeltLine have experienced above-average appreciation, and the ongoing expansion ensures continued growth potential.

Additionally, improvements to the city’s transit system, MARTA, are enhancing connectivity across neighborhoods, making properties near transit lines more desirable. These projects attract both renters and buyers seeking convenience and walkability.

Read more: Top Tips for Atlanta Landlords to Maximize Profit

Tax Benefits for Investors

Real estate investors in Georgia benefit from several tax incentives, including deductions for mortgage interest, property taxes, and depreciation. These deductions can significantly reduce your tax burden and enhance overall returns.

Moreover, Georgia does not impose estate or inheritance taxes, making it an appealing market for long-term investors planning to pass properties on to future generations.

Favorable Population Growth Projections

Population growth is a cornerstone of Atlanta’s real estate strength. By 2050, the metro area is expected to gain another 1.8 million residents, ensuring continued demand for housing.

Suburban areas like Sandy Springs and Alpharetta are experiencing significant growth as families seek more space and better schools without sacrificing access to Atlanta’s amenities. These areas offer great opportunities for investors targeting long-term rental demand.

Future Market Projections

Experts predict that Atlanta home prices will grow by an average of 6% annually, outpacing national trends. Rental rates are also expected to rise as demand increases, driven by new residents and limited housing supply.

For investors, this combination of rising property values and strong rental demand makes Atlanta a lucrative choice for building wealth over the long term.

Key Considerations for Atlanta Investors

Location is Everything

Investing in neighborhoods with strong growth potential can significantly impact your returns. Established areas like Buckhead and Midtown are known for their high rental yields, while revitalized neighborhoods like Old Fourth Ward and East Atlanta Village offer opportunities for appreciation.

Safety and Community

Before purchasing, research crime rates and community amenities. Properties in safe, vibrant neighborhoods tend to attract more tenants and retain their value over time.

Leverage Professional Management

Managing a property remotely or as a side project can be challenging. Partnering with a property management company ensures your investment is well-maintained, tenants are screened carefully, and rental income is maximized.

How Property Management Maximizes Returns

Owning property is just the first step—managing it effectively ensures profitability. At Home365, we take the hassle out of property ownership. From marketing vacancies to handling repairs and tenant relations, we manage every detail to protect your income and increase your returns.

Whether you’re a local investor or buying from out of state, our expert team ensures your property operates smoothly, so you can focus on expanding your portfolio.

Is Atlanta Right for Your Investment Portfolio?

Atlanta’s thriving economy, rising property values, and strong rental demand make it a compelling market for real estate investors. With a proactive strategy and the right support, you can capitalize on the city’s incredible growth potential.

If you’re ready to take the next step or want to maximize the value of your existing investment, contact Home365 today. Let us help you achieve your real estate goals while making property ownership stress-free.