Las Vegas continues to transform beyond the glittering lights of The Strip. Economic diversification, rapid growth in tech and entertainment sectors, and ongoing infrastructure enhancements are all converging to create an excellent environment for real estate investment. With stable inventory levels, a balanced market, and consistent sales trends, 2025 is shaping up to be a prime year for purchasing single-family homes in strategic Las Vegas neighborhoods.

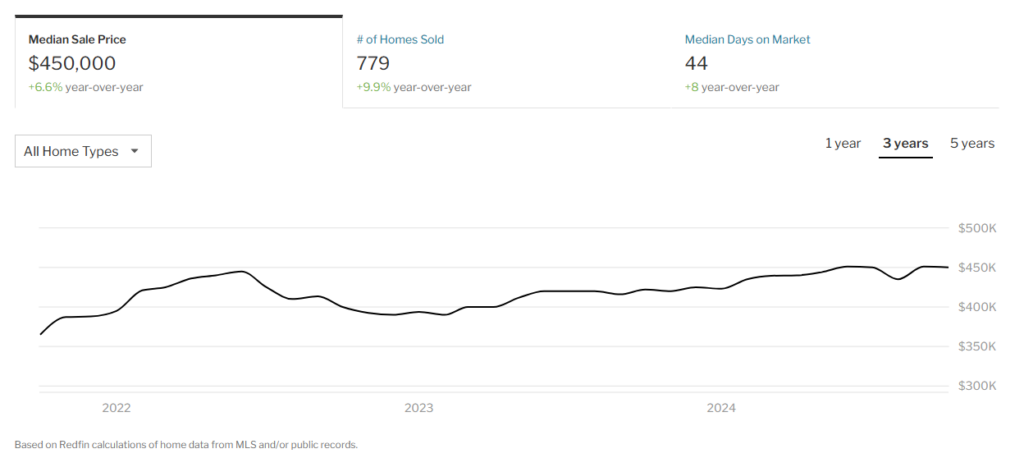

According to recent market data, the single-family residential (SFR) inventory in Las Vegas has hovered around 6,100 units in late 2024, with roughly 1,800 units sold monthly. This equates to around 3.4 months of inventory—an indicator of a balanced market where demand and supply are well-aligned. For investors, this stability reduces volatility and fosters predictable growth. Moreover, the region is experiencing steady appreciation in property values, with median home prices approaching record highs and condos/townhomes breaking into new price territories.

Beyond just the numbers, the city’s future looks exceptionally bright. From space technology ventures and major film studio expansions to new pro sports franchises and improved transportation via the Brightline West high-speed rail, Las Vegas is evolving into a cultural, economic, and entertainment hub. Institutional investors have taken note—contributing to stable rental demand and robust housing values. For individual investors, these conditions mean ample opportunities for long-term returns.

Here are the top five places to invest in single-family homes in Las Vegas in 2025

1. Anthem (Henderson)

Why Invest?

Anthem, nestled in Henderson, consistently ranks among the safest and most family-friendly areas in Southern Nevada. High-quality schools, well-maintained parks, and proximity to major employment centers and the Strip make it a sought-after neighborhood for long-term renters. Given the city’s stable 3.4-month inventory and moderate price appreciation, Anthem’s single-family homes promise reliable returns with less volatility than markets prone to extreme bidding wars.

Investment Highlights:

- Balanced Market: Anthem’s stable supply and demand supports steady rental income and appreciation.

- Quality of Life: Top-rated schools, parks, and trails attract discerning families.

- Strong Value Growth: Historical appreciation trends position Anthem as a safe bet for long-term investors.

Read more: Emergencies in Your Las Vegas Rental: Essential Tips for Property Owners

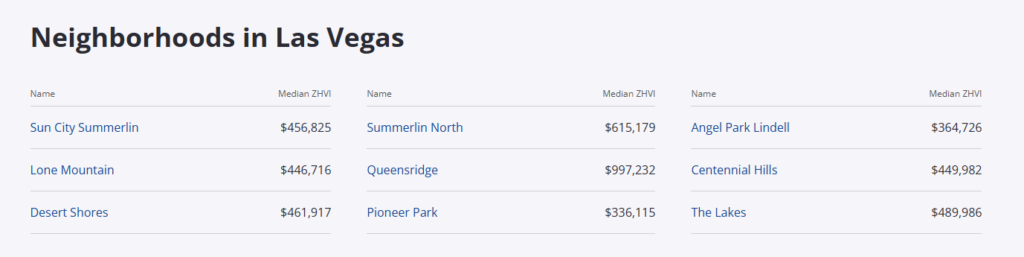

2. Centennial Hills

Why Invest?

Centennial Hills in northwest Las Vegas offers affordability and diverse property options. With Red Rock Canyon and the Tule Springs Fossil Beds nearby, it appeals to families, retirees, and young professionals seeking a suburban lifestyle close to nature. The area’s consistent sales volume, coupled with a balanced month-over-month inventory, ensures predictable occupancy rates and stable rental growth.

Investment Highlights:

- Affordability & Stability: Lower entry costs with steady inventory mitigate risk.

- Strong Tenant Demand: Families value top-notch schools like Arbor View High School.

- Outdoor Amenities: Parks, hiking, and outdoor spaces encourage long-term residency.

3. Green Valley South (Henderson)

Why Invest?

Green Valley South remains a standout for investors targeting stable, well-maintained neighborhoods. Its manicured landscaping, strong HOA oversight, and robust community events create a neighborly atmosphere that encourages renters to stay longer. With the overall Las Vegas market showing moderate yet consistent appreciation (condos and townhomes recently hit record prices), single-family homes here remain competitively priced and poised for value growth.

Investment Highlights:

- Community Appeal: Annual events and HOA initiatives enhance neighborhood desirability.

- Travel Convenience: Proximity to Harry Reid International Airport and I-215 caters to professionals.

- Stable Appreciation: Well-established community ensures reliable, incremental property value increases.

4. Southern Highlands

Why Invest?

Southern Highlands stands out for its scenic environment, tree-lined streets, and abundant recreational amenities. The area’s stable conditions mirror the broader Las Vegas market trends: balanced inventory, modest price increases, and steady rental demand. As Las Vegas continues to diversify into entertainment (Warner Bros. expansion, Hollywood 2.0 initiatives), tourism, and even space technology sectors, Southern Highlands is positioned as a high-quality residential alternative within easy reach of these new economic centers.

Investment Highlights:

- Strong Market Fundamentals: Predictable rent appreciation and stable occupancy.

- Lifestyle Perks: Golf courses, parks, and regular community events.

- Close to Growth Hubs: Easy freeway access to emerging entertainment and tech hubs.

Read more: Eviction Laws in Las Vegas, Nevada

5. Summerlin

Why Invest?

Summerlin’s reputation as a premier master-planned community persists into 2025 and beyond. With world-class amenities, extensive trails, and proximity to Red Rock Canyon, it appeals to a broad demographic—families, young professionals, retirees—all seeking upscale suburban living. As institutional investors remain interested in Las Vegas rentals and as major film studios eye the region (Sony’s $1.8B project, Mark Wahlberg’s involvement, Warner Bros. expansions), Summerlin will likely benefit from an influx of tenants seeking quality neighborhoods, ensuring long-term, stable returns.

Investment Highlights:

- Proximity to Growth Drivers: Future NBA and MLB teams, plus new entertainment complexes, bolster demand.

- Robust Tenant Pool: Affluent renters look for top-tier amenities and good schools.

- Consistent Appreciation: Supported by balanced inventory and investor confidence.

Market Stability & Future Outlook

The key differentiator in 2025’s Las Vegas housing landscape is stability. With about 3.4 months of inventory, prices nearing record highs, and an influx of institutional investors ensuring steady rental demand, the conditions are ideal for strategic acquisitions. Condo and townhome prices have set new records, and while single-family homes haven’t quite hit their previous peak, they’re trending upward, suggesting room for growth.

Las Vegas also anticipates transformative projects on the horizon—from spaceport plans to Hollywood 2.0 expansions in Summerlin and major league sports additions—further diversifying its economic base. As infrastructure and cultural amenities grow, so does the attractiveness of well-located single-family homes.

In Conclusion

Las Vegas, with its balanced inventory and robust tenant interest, is primed for sustainable real estate investment gains. Anthem, Centennial Hills, Green Valley South, Southern Highlands, and Summerlin each offer unique advantages—be it top-rated schools, outdoor recreation, strong community bonds, or immediate proximity to emerging entertainment sectors. Partnering with knowledgeable local experts, such as Rice Real Estate & Property Management, can help ensure you capitalize on Las Vegas’ evolving market, setting the stage for long-term stability and returns in 2025 and beyond.

If you’re ready to take the next step or want to maximize the value of your existing investment, contact Home365 today. Property management that protects your profit and makes property ownership stress-free is just a call away—let us help you achieve your real estate goals.